Top Guidelines Of Medigap

Wiki Article

The Best Guide To How Does Medigap Works

Table of Contents3 Simple Techniques For How Does Medigap WorksAbout Medigap BenefitsMedigap Can Be Fun For AnyoneFacts About How Does Medigap Works RevealedMedigap Can Be Fun For Everyone

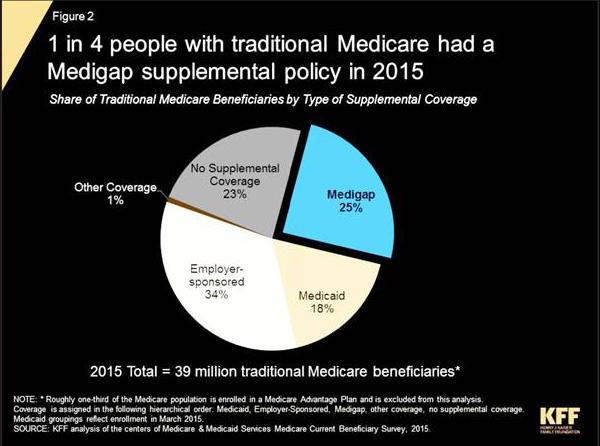

Medigap is Medicare Supplement Insurance that aids fill "voids" in Original Medicare and also is offered by private firms. Initial Medicare spends for much, but not all, of the cost for protected healthcare services and also products. A Medicare Supplement Insurance (Medigap) policy can aid pay several of the staying health and wellness care expenses, like: Copayments Coinsurance Deductibles Note Note: Medigap intends offered to people brand-new to Medicare can no more cover the Part B insurance deductible.Nevertheless, if you were eligible for Medicare prior to January 1, 2020, however not yet signed up, you might have the ability to get among these plans that cover the Part B deductible (Strategy C or F). If you already have actually or were covered by Plan C or F (or the Strategy F high deductible version) prior to January 1, 2020, you can keep your strategy.

Your Medigap insurance policy business pays its share. 9 points to understand about Medigap plans You need to have Medicare Part An and Component B. A Medigap policy is various from a Medicare Benefit Plan. Those strategies are methods to get Medicare advantages, while a Medigap plan only supplements your Initial Medicare advantages.

You pay this monthly premium in enhancement to the month-to-month Part B premium that you pay to Medicare. You can purchase a Medigap plan from any kind of insurance business that's accredited in your state to sell one.

Everything about Medigap Benefits

A Medigap strategy (additionally called a Medicare Supplement), sold by private firms, can help pay some of the health treatment prices Initial Medicare does not cover, like copayments, coinsurance as well as deductibles. Some Medigap plans also use protection for services that Original Medicare does not cover, like medical care when you take a trip outside the United state

Keep in mind that you can only have a Medigap if you have Original Medicare.

The Main Principles Of Medigap

If you have lately enlisted in Medicare, you may have listened to of Medigap strategies as well as asked yourself how they function. Medigap plans, additionally known as Medicare Supplement plans, aid cover some out-of-pocket costs connected with Initial Medicare.

When you sign up, your Medicare Advantage Plan takes control of the administration of your Medicare Part An and also Medicare Part B protection. Medigaps are planned simply to cover the Medicare expenses that Original Medicare delegates the beneficiary. If you have a Medigap policy, Medicare pays its share of the Medicare-approved quantity for protected solutions and after that your Medigap policy will certainly pay its share of protected advantages.

In 2022 with Strategy F, you can anticipate to pay between $160 and also $300. Plan G would generally vary in between $90 as well as $150, and also Plan N would certainly be about $78 to $140. What is Medigap.

The Buzz on What Is Medigap

Registering in a Medicare Supplement insurance policy plan will certainly assist in covering costs. Step 1: Make a decision which advantages you desire, after that choose which of the Medigap plan kinds (letter) satisfies your requirements. Action 2: Discover out which insurance policy business sell Medigap plans in your state. Action 3: Find out about the insurance provider that sell the Medigap plans you have an interest in and also contrast costs.The very best time to look for a Medicare Supplement plan is during your six-month Medigap Open Enrollment Duration. The Open Registration Period begins the first month you have Part B insurance coverage and also you're 65 or older. Since Medigap plans are offered by private insurance policy business, they are normally allowed to utilize medical underwriting to determine whether or not to accept your application and what your price will certainly be.

The following elements can influence the expense of Medicare Supplement prepares: Your area Your gender Your age Cigarette usage Home price cuts Exactly how you pay When you enroll Medigap costs have to be authorized by the state's insurance policy division as well as are established based on strategy background as well as operating costs. There are three rankings made use of that can influence your prices What is Medigap as well as price boosts.

Issue Age doesn't indicate the strategy will not see a rate boost. You will generally pay even more when you're more youthful however less as you age.

Not known Incorrect Statements About How Does Medigap Works

Still, the rate will raise quicker than the issue age. Community Rated: Area rating implies every person in the community pays the same rate. These are generally extra expensive when you start yet will certainly level out in time. Many states as well as providers utilize the acquired age rating when valuing their Medicare Supplement insurance.Report this wiki page